Offshore Trusts as a Legal Strategy to Minimize Financial Exposure

Offshore Trusts as a Legal Strategy to Minimize Financial Exposure

Blog Article

Why You Ought To Think About an Offshore Trust for Shielding Your Assets and Future Generations

If you're looking to safeguard your wide range and assure it lasts for future generations, taking into consideration an overseas count on could be a clever action. As you discover the possibility of overseas trust funds, you'll uncover just how they can be tailored to fit your details demands and goals.

Comprehending Offshore Trust Funds: What They Are and Just How They Function

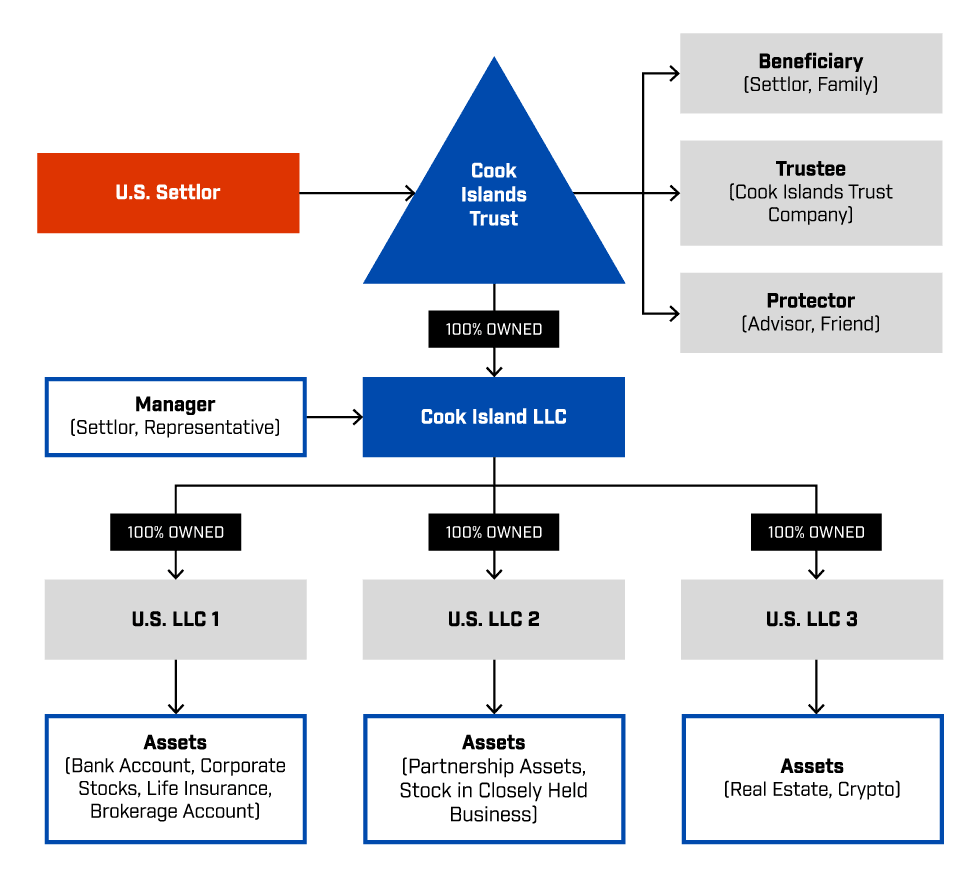

When you believe regarding safeguarding your assets, offshore counts on may come to mind as a feasible alternative. An offshore count on is a lawful plan where you transfer your assets to a trustee situated in one more country.

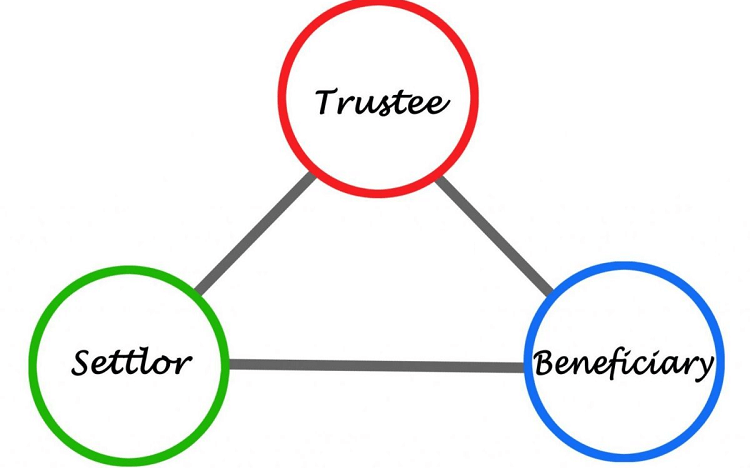

The secret elements of an offshore depend on include the settlor (you), the trustee, and the beneficiaries. Comprehending just how offshore depends on function is important before you decide whether they're the best option for your possession security method.

Benefits of Establishing an Offshore Trust

Why should you take into consideration developing an overseas depend on? In addition, overseas depends on supply flexibility regarding possession administration (Offshore Trusts).

Another trick benefit is privacy. Offshore trust funds can supply a higher level of discretion, protecting your economic events from public scrutiny. This can be crucial for those wanting to maintain their riches discreet. Developing an overseas depend on can advertise generational wealth conservation. It enables you to set terms for just how your assets are dispersed, guaranteeing they benefit your future generations. Ultimately, an overseas depend on can function as a critical tool for protecting your financial tradition.

Shielding Your Properties From Legal Insurance Claims and Creditors

Establishing an offshore trust fund not just provides tax advantages and personal privacy but also acts as an effective guard versus legal claims and creditors. When you put your properties in an offshore depend on, they're no longer considered part of your individual estate, making it a lot harder for lenders to access them. This splitting up can secure your wide range from lawsuits and insurance claims developing from service disputes or individual responsibilities.

With the ideal territory, your properties can benefit from strict personal privacy laws that prevent lenders from seeking your wide range. In addition, many overseas trusts are developed to be testing to permeate, usually needing court action in the trust fund's jurisdiction, which can serve as a deterrent.

Tax Obligation Performance: Lessening Tax Obligation Obligations With Offshore Depends On

Furthermore, because depends on are commonly taxed in different ways than individuals, you can profit from reduced tax rates. It's crucial, nonetheless, to structure your depend on correctly to guarantee conformity with both residential and worldwide tax laws. Dealing with a certified tax expert can assist you navigate these complexities.

Making Sure Personal Privacy and Privacy for Your Riches

When it pertains to securing your wide range, assuring privacy and confidentiality is vital in today's increasingly transparent monetary landscape. An overseas count on can offer a layer of protection that's tough to accomplish via domestic choices. By placing your properties in an overseas jurisdiction, you protect your financial info from public examination and reduce the danger of undesirable focus.

These trusts frequently include strict personal privacy regulations that prevent unauthorized access to your monetary information. This suggests you can safeguard your riches while maintaining your peace of mind. You'll also limit the possibility of legal conflicts, as the details Related Site of your count on stay personal.

In addition, having an offshore trust implies your possessions are less vulnerable to personal obligation insurance claims or unexpected financial situations. It's a proactive step you can take to assure your monetary legacy continues to be intact and personal for future generations. Count on in an overseas structure to secure your wide range efficiently.

Control Over Asset Distribution and Management

Control over asset circulation and management is just one of the vital advantages of establishing an overseas trust. By establishing this depend on, you can dictate just how and when your assets are dispersed to beneficiaries. You're not just turning over your riches; you're setting terms that mirror your vision for your legacy.

You can develop details problems for distributions, guaranteeing that beneficiaries fulfill specific criteria before receiving their share. This control assists prevent mismanagement and assurances your possessions are utilized in ways you consider proper.

In addition, designating a trustee enables you to hand over management duties while retaining oversight. You can choose somebody that aligns with your worths and understands your goals, guaranteeing your possessions are taken care of wisely.

With an overseas trust fund, you're not only securing your riches yet likewise shaping the future of your beneficiaries, offering them with the support they need while keeping your preferred level of control.

Picking the Right Territory for Your Offshore Trust Fund

Try to find countries with strong legal frameworks that sustain trust regulations, guaranteeing that your assets continue to be i was reading this secure from possible future cases. Furthermore, availability to regional monetary organizations and knowledgeable trustees can make a big distinction in handling your trust fund effectively.

It's vital to examine the costs involved as well; some jurisdictions might have higher setup or upkeep fees. Ultimately, choosing the appropriate territory suggests straightening your economic goals and family requires with the details advantages supplied by that location - Offshore Trusts. Take your time to research study and consult with experts to make the most informed decision

Regularly Asked Inquiries

What Are the Prices Connected With Setting up an Offshore Trust Fund?

Establishing up an offshore trust includes different expenses, including legal charges, setup charges, and recurring upkeep costs. You'll want to allocate these variables to assure your trust operates successfully and successfully.

Exactly How Can I Locate a Trusted Offshore Trust Provider?

To find a trusted offshore trust fund copyright, study online testimonials, request for referrals, and confirm qualifications. Make sure they're seasoned and clear regarding charges, services, and guidelines. Depend on your reactions throughout the choice process.

Can I Handle My Offshore Trust Fund Remotely?

Yes, you can handle your overseas count on remotely. Numerous providers provide on-line gain access to, enabling you to check investments, communicate with trustees, and website here gain access to papers from anywhere. Just guarantee you have secure web accessibility to secure your information.

What Takes place if I Move to a Various Nation?

If you transfer to a various nation, your overseas count on's guidelines might alter. You'll need to talk to your trustee and possibly adjust your count on's terms to adhere to neighborhood laws and tax implications.

Are Offshore Trusts Legal for People of All Countries?

Yes, offshore trust funds are lawful for people of numerous countries, but guidelines differ. It's necessary to research your country's laws and consult a lawful professional to assure compliance and understand prospective tax implications before proceeding.

Report this page